You feel devastated, violated, helpless and angry.

You don’t know how this happened and you are looking for answers.

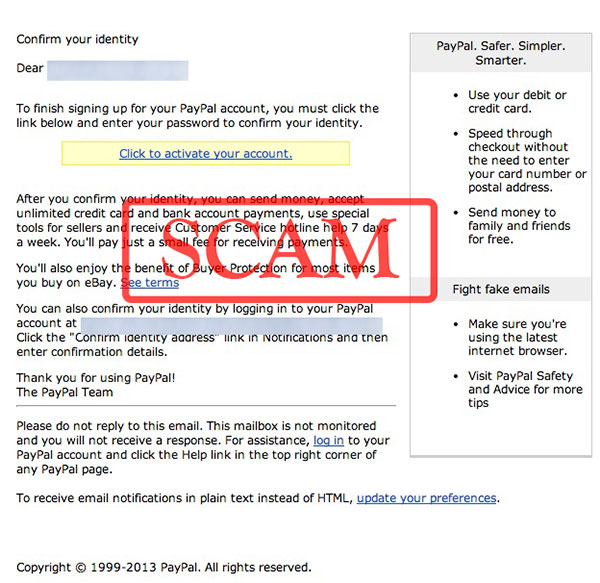

Picture the situation – you go into your email account and there’s a worrying email from your bank or payment solution provider.

You open the email and you find out that there has been unusual activity on your account. Your payment solution provider is telling you that your account has been temporarily blocked until this situation has been resolved.

Taking care of your money is their utmost priority.

All you have to do is log into your account by clicking the link and confirming your identity to restore your account.

What do you do?

- Phone the friendly support person on the telephone number given in the email

- 50:50 – Click on a link in the email or do nothing

- Ask the audience – What do the other emails say that your payment solution provider has been sending?

The answer

Do nothing. It’s a scam.

What has happened?

Someone wants to get access to your account and have set up a fake website via the email. As you log on to your account, via the fake link, they will record your password and user name. They may then have access to your account, or at least enough information to attempt identity theft.

Their next step will be to enter your account to change your password, remove your phone number and take your hard-earned money.

Prevention is better than cure

When you find yourself in receipt of an alarming email it is really easy to panic because we all want to protect our accounts whether they are bank accounts, social media accounts or some other form of membership account.

But if you receive an email telling you that there is a problem with one of your accounts – it’s very important to stay calm and take the following steps:

- Don’t click on the links in the email – it is an easy mistake to make but it could prove very costly

- Call your provider directly to check with them whether or not there really is a problem to be addressed in relation to your account with them but don’t use the telephone number given in the email

- If you can’t call your provider or get answers from them right away, then send them an email to a known address – don’t click “reply” on the fake email.

- Never enter a personal account of any importance to you via an unsecure internet connection – doing so is asking for trouble

- Don’t enter your account details or any identifying information in public places such as cafes or airports where there is communal Wi-fi because you will usually be at a higher risk of being hacked in these scenarios. If there’s no password to get connected then you should be especially wary.

- Make any account passwords you use over 12 characters and a mixture of letters, numbers and symbols – see my blog on 5 ways to make your data and your business safer.

- Finally, if your computer/phone/laptop is acting weird and unfamiliar internet pages keep appearing then your computer might be infected so don’t log onto any of your accounts for a while and especially not your bank account until you can get it checked.

Unfortunately, it could be that you will one day fall victim to a hacker attack and see one of your devices or secure accounts compromised.

For the most part though hackers aren’t actually able to get straight into a bank account or a payments system but what they can do is trick people into coughing up their details via an email scam or by sneaking into their devices.

So you should always be looking out for signs of a potential scam in progress and especially whenever you get an email telling you that your accounts have been compromised and immediate actions are required.

Leave a Reply

You must be logged in to post a comment.